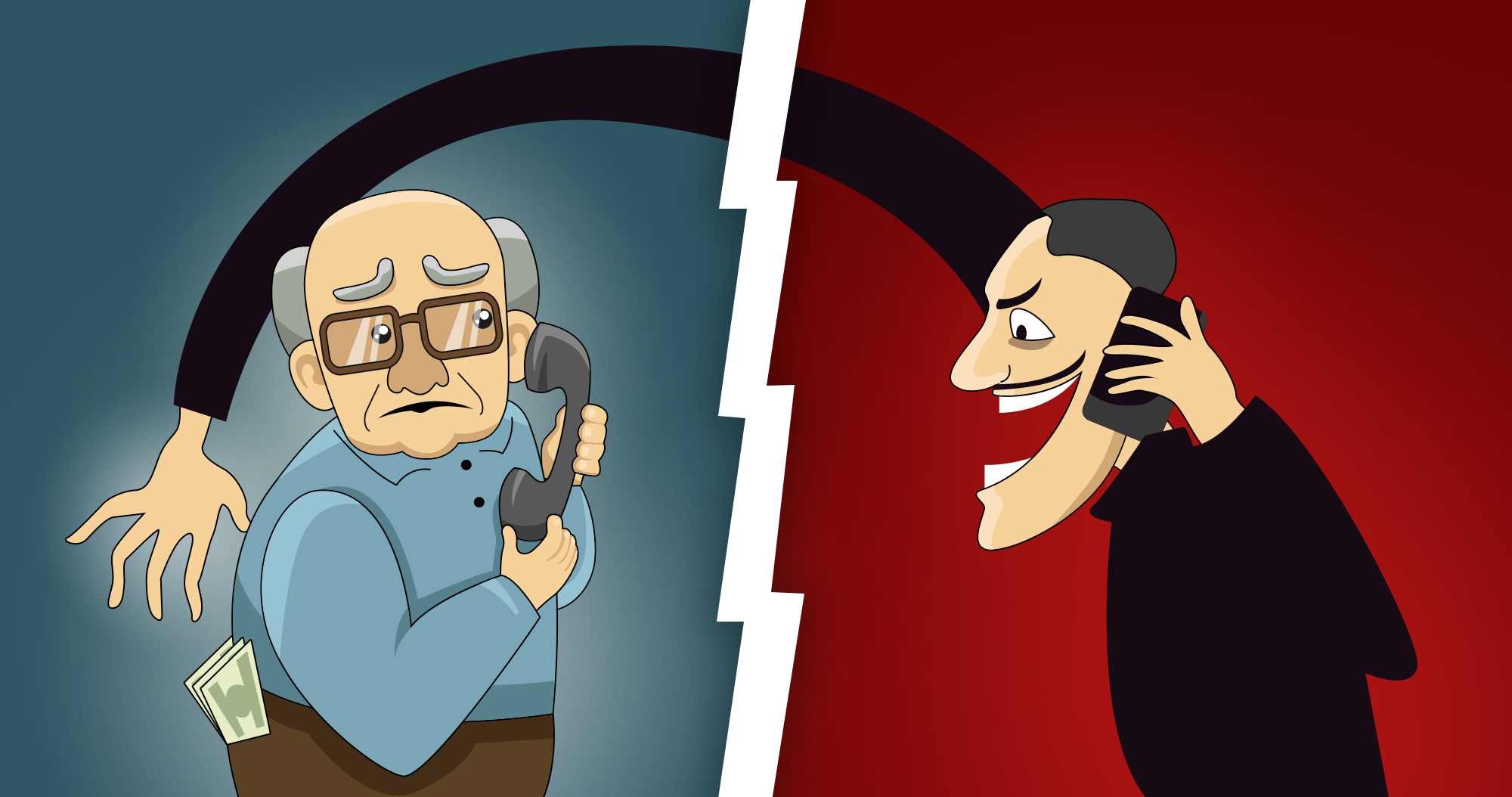

As bad as it may sound, internet and telephone scams will always be a part of our lives. There are a lot of desperate individuals in the world who will do anything for money and they're not afraid to target and hurt a lot of innocent people.

While many of us can easily recognize scams, there are some who easily fall for them. In an attempt to protect the population, the IRS has been compiling an annual report which lists the most common scams including identity theft and fake charity solicitations.

Despite their efforts people are still losing money to con artists. So what can you do to protect yourself from scammers?

Never trust anyone asking for money or private information over the phone or online. If you want to verify that a call is coming from a credible source, don't pick-up, instead return their call using an official number like the one on the back of your credit card.

Con artists can "alter the caller ID to make it look like the IRS is calling. They use fake names and bogus IRS identification badge numbers. If you don't answer, they often leave an "urgent" callback request," according to a statement on the IRS website.

Earlier this year, a "can you hear me now?" phone scam was recording unsuspected people saying "yes," then their responses were used to authorize credit card payments. If you pick up a call from a number you don't recognize, avoid answering any yes or no questions.

If you think you've fallen victim to a scam, immediately contact the police as well as your credit card company then file a complaint using the FTC Complaint Assistant.

Recently, a tax-related phone scam began to spread across the country. Click on the next page to see how it could affect you.

If you receive a call claiming to be the IRS and asking for money, hang up and report it right away. There's a new scam on the rise and it is taking a toll on the wallets of many Americans.

The scammers are calling taxpayers and using threats of lawsuits and arrests to con them for money.

"These telephone scams are being seen in every part of the country, and we urge people not to be deceived by these threatening phone calls," said IRS Commissioner John Koskinen. "We have formal processes in place for people with tax issues. The IRS respects taxpayer rights, and these angry, shake-down calls are not how we do business."

A 69-year-old man in Madison, Wisconsin almost fell for the scam when he received a call informing him that a warrant has been issued for his arrest after he failed to pay the tax he owes.

Luckily, he got in touch with the authorities and avoided being tangled in a mess.

"It is always in the best interest of anyone to not communicate with individuals you do not know, and have not appropriately established themselves as credible entities of an organization," said Madison police spokesman Howard Payne.

The IRS also wants people to know that they do not ever demand payments over the phone and they certainly do not issue threats of involving law enforcement for not paying. They also do not solicit people over email, social media or text message to discuss personal tax issues.

Share this information with anyone you know to keep them safe from all these scams!